Acquisition project | Headout | Sumana Paul

Elevator Pitch

Product name: Headout

Elevator pitch:

Hi! I am Sumana, Growth Manager at Headout.

Headout is a travel marketplace designed to make every trip unforgettable. We connect you with handpicked experiences, verified destinations, and last-minute booking options, ensuring a hassle-free journey from start to finish. Whether you’re a solo traveler or planning a luxurious family escape, we tailor each experience to your preferences and budget.

Our focus is to enhance your journey by providing high-quality experiences that let you fully immerse in your travels—without the worry of logistics.

Company url:

Understanding product

About Headout

- Founded: 2014 by Varun Khona, Suren Sultania, and Vikramjit Singh.

- Headquarters: New York, USA.

- Funding: Raised ovr $60 million, including a recent $30 million Series B round to expand its offerings to 500 cities

- Core Offerings: Headout aggregates third-party activities, tours, and tickets for tourists and locals, focusing on last-minute bookings and curated experiences.

- Market Presence: Has already served over 20 million travellers across 81 destinations and operates in major cities like New York, Las Vegas, London, and Dubai.

SWOT Analysis

Strengths

- Strong relationships with local experience providers allows Headout to list a wide range of experiences in a destination they have built presence in

- Appeals to spontaneous travelers looking for immediate experiences.

Weaknesses

- Limited brand recognition compared to established competitors like Viator and GetYourGuide.

- Quality control may vary depending on partners.

Opportunities

- Post-pandemic recovery has led to a surge in local tourism. Opportunity to fulfil local tourism demand in India if Headout solves for supply

- Opportunities to enhance user experience through AI using Dabble, their latest acquisition in the AI industry

Threats

- Faces strong competition from local players like Thrillophilia who is building supply outside India, international players such as Viator (acquired by Tripadvisor), and GetYourGuide.

- Shifts in travel habits could impact demand for certain types of experiences. Time, effort and cost of building supply in any country is high for a travel company. Hence Headout has to be mindful of audience behaviour before making investments to expand

Core value proposition:

Headout promises its customers the following things,

- curated high-quality experiences from across the globe in one place to make travel convenient

- caters to all kinds of tastes and interests

- best deals and superior customer experience

Understanding users

User feedback and acceptance of Headout:

Headout is popular among Indians as a platform where you can discover high-quality experiences in international locations. In short, India is an already established source-market.

Lets look at some indicators :

- Indian travellers have booked tickets through Headout at international destinations and are aware of the existence of this platform. Early adopters of the platform are satisfied with the overall experience of using Headout and even recommend it to their friends.

- India is the 4th largest country in terms of how much organic search traffic Headout gets from across the world. Also there are 40k organic traffic from India every day

- Not only that, if you look at search intent data, about 11% which is approx. 4.4k traffic is coming with ‘Transactional intent’ which is a Bottom-of-the-funnel search intent. Clearly, people who are about to buy/convert are also visiting Headout

- Also, out of 268k visitors in Sep, 44% directly visited the website which is a strong indicator of brand awareness

Some more observations regarding user feedback:

- the product is able to deliver on its promise (curated experiences for all, best deals, good customer experience)

- users are hitting ‘aha’ moments in their journey

- users are bragging about it

Let's look at some indicators:

User bragging about smooth user flow and would most likely recommend it to friends. In the above screenshot we can see that the user has hit his ‘aha’ moment while booking his experience through the platform.

User bragging about smooth user flow and would most likely recommend it to friends. In the above screenshot we can see that the user has hit his ‘aha’ moment while booking his experience through the platform.

User bragging about ease of use + good deals they got on Headout.

User bragging about ease of use + good deals they got on Headout.

User’s issue resolved by Headout team showing their focus on customer support.

User’s issue resolved by Headout team showing their focus on customer support.

Above are some instances where users or early adopters of the platforms have used the platform and are satisfied with the service. They will most likely refer the same to their friends.

Hence we can consider Headout to be an early scaling company in India.

ICP Analysis:

Lets analyse the Ideal Customer profiles for Headout (there are 3 ICPs, please scroll the table to see all 3)

Criteria | ICP 1: Solo-traveler with clear budget | ICP 2: Family-tripper with clear budget | ICP 3: Family-tripper and can afford luxury |

Age & Gender | gender: M/F age: 18-30generation: GenZ, Millenials | gender: M/Fage: 30-45generation: Millenials | gender: M/Fage: 30-45generation: Millenials |

Annual Income | 7-15LPA | Middle income; 15-30LPA | High income; 30LPA+ |

Workplace | Employees or interns in tech startups (pre-PMF/seed/early stage), Freelancers | MNCs | MNCs/business owners |

Relationships | Single | Family with kids | Family with kids |

Where do they live | Metro, Tier 1 | Metro, Tier 1 | Metro, Tier 1 |

Apps on phone | Whatsapp, YT, IG, GetYourGuide, TripAdvisor, MMT, Skyscanner, Klook, Finshots, Splitwise, LinkedIn, Canva | Whatsapp, YT, IG, TripAdvisor, MMT, Skyscanner LinkedIn | Whatsapp, YT, IG, TripAdvisor, MMT, LinkedIn, Finshots, Groww, smallcase |

Social media they use | IG, Snapchat, Linkedin | IG, Linkedin, Facebook | IG, Linkedin |

Who do they follow | Influencers in Fitness, Finance, Travel; Comedians; Bolly celebs | Influencers in Fitness, Finance; Comedians; Bolly celebs | Influencers in Fitness, Finance, Travel; Comedians; Bolly celebs |

Frequency of travel | 2 international, 1 domestic | 1 international, 1 domestic | 2 international per year, 1 domestic every other year |

What is more valuable | Quality>Money>Time | Money>Time>Quality | Quality>Time>Money |

Pain points they are concerned about while booking travel experiences | 1. Unclear if prices on the platform is same or more expensive than what is offered at the destination locally2. Local transport options around the experience points; for to and fro commute from hotel/airbnb3. Safety concern for women travelers 4. Are the reviews genuine? Because we rely heavily on reviews5. Too much planning to do as i am a solo-traveler | 1. Unclear if prices on the platform is same or more expensive than what is offered at the destination locally 2. Local transport options around the experience points; for to and fro commute from hotel/airbnb 3. Food and hygiene options4. Are the reviews genuine? Because we rely heavily on reviews | 1. How to plan so that most of the best places can be covered in limited time? 2. Will i get exclusive access/customised dining option?3. Can anyone help plan my experiences tailored to my tastes and interest? |

Job to be done related to travel | - Functional Goal: Wants to travel as frequently as possible, with limited budget so that this can be repeated every year - Social Goal: Bragging factor among peers; want to be considered a well-traveled person- Personal Goal: Wants to see the world, make memories before settling down in life | -Functional Goal: Wants to plan a safe, comfortable holiday without burning a hole in their pocket- Social Goal: Bragging factor among peers- Personal Goal: Wants their family to be happy and see the world with them | - Functional goal: Wants to plan a personalised, comfortable holiday without being off of work for too long - Personal: Take some time off and return to work rejuvenated, inspired |

Types of experiences they like to have during vacation | -outdoor adventure such as ziplining, skydiving etc- concerts, nightlife, pub crawls- hop on hop off tours - food tours -local, authentic experiences | -Cruises-Museums, zoos, parks-City tours-Public transport, train/ferry passes- travel insurance | -local, authentic experiences - dining, wineries- immersive experiences- shopping, cooking classes- dinner cruises- spa sessions- hot air balloon- opera |

What offerings/features of a experience booking platform do they value the most | 1. curated experiences, categories from tours & tickets to aerial sightseeing - helps to discover experiences that was not in the initial plan, sparks spontaneity2. detailed view of the experience i.e. Maps, Dos and Donts, Highlights, Inclusions and Exclusions, Customer Reviews and Ratings to avoid surprises later | 1. Bundled experiences e.g 10D Thailand package, 5N/6D Vietnam package etc2. Free Cancellation policies 3. detailed view of the experience i.e. Maps, Dos and Donts, Highlights, Inclusions and Exclusions, Customer Reviews and Ratings to avoid surprises later | 1. Concierge service for bookings, tours, sight-seeings 2. Exclusive access |

Where do they go to discover/learn about activities and experiences at the planning stage | - ask friends who have travelled to that country before- Google search results - favourite travel influencer on IG | - ask friends who have travelled to that country before - ads on google and socials | - ask friends- ads on google and socials - travel influencers on IG |

BUYER COMMITTEE | |||

Buyer | Traveler themselves | Traveler themselves | Traveler themselves |

Influencer | Friends, Colleagues | Spouse, Children | Spouse, Children |

Blocker | NA | NA | NA |

ICP prioritisation

- Adoption curve: This will be the lowest for young solo travelers who are least resistant to new technologies and are looking for unique adventures while traveling. For the other 2 ICPs, adoption curve is medium; however, being millenials who shop online and use social media, they have a tendency to quickly learn and adapt.

- Frequency of use/travel: More solo travelers and luxury family trippers are taking 2 or more international vacations in a year than family trippers who are on budget.

- Appetite to pay: Families who are taking vacations on a budget have less appetite to pay for multiple experiences in a vacation

- TAM: Families taking vacations on budget might not be taking vacations abroad every year. They prefer domestic destinations for yearly travels with international holidays once every couple of years.

- Distribution potential: All 3 ICPs being from metro and tier 1 cities and online shoppers who spend time on social media, there is very low resistance to reaching each of them.

Based on the above analysis, we will be targeting the following 2 ICPs during early scaling phase:

- Solo travelers with budget (ICP 1)

- Family-trippers who can afford luxury (ICP 3)

Positioning of Headout:

Based on our chosen ICPs’ preferences Headout needs to position itself as,

An online platform that helps you discover the best deals for authentic local experiences wherever you're traveling.

Understanding market

Broad Competitive Analysis

Company name | URL | Origin country | Cross-visitation % | Avg. monthly organic traffic from India |

Thrillophilia | India | Not found | 7.5mn | |

GetYourGuide | Germany | 17.90% | 57k | |

Rayna tours | UAE | Not found | 12k | |

Tiquets | Netherlands | Not found | 3k | |

Viator (parent company Tripadvisor) | USA | 17.80% | 600k | |

Klook | Hong Kong | 13.50% | 350k |

Monthly organic traffic of Headout is ~ 40k. Hence the closest rival in terms of traffic volume is GetYourGuide. However let us also analyse top 2 competitors by traffic volume i.e Thrillophilia, Viator.

Thrillophilia

Core unique use cases:

- Local Experience Focus - Specializes in offering unique local tours and adventure activities in India and abroad.

- Customizable Packages - Allows users to create tailored travel itineraries that suit their specific interests and group sizes.

Thrillophilia vs Headout

Aspect | Thrillophilia | Headout |

Market Focus | Primarily focuses on adventure tourism and experiential activities in India and abroad. | Offers a broader range of travel experiences, including last-minute bookings and curated tours worldwide. |

User Engagement | Engages a youthful demographic that prefers offbeat and adventurous experiences; strong community focus. | Targets a broader audience including last-minute travelers; user engagement strategies are still evolving. |

Established Brand | Founded in 2011, Thrillophilia has built a strong brand presence in the Indian market, particularly among adventure seekers. | Founded in 2014, Headout is growing rapidly but is still establishing its brand recognition in India. |

GetYourGuide

Core unique use cases:

- Diverse Global Offerings- Provides access to over 60,000 bookable activities worldwide, including exclusive experiences.

- Personalization and Data Utilization- Leverages user data to offer personalized recommendations, enhancing the booking experience.

GetYourGuide vs Headout

Aspect | GetYourGuide | Headout |

Global Reach | Operates in over 7,500 destinations worldwide, providing a vast selection of experiences. | Currently offers services in 40 cities, with plans to expand to 250 cities following recent funding. |

Brand Recognition | Established brand with significant trust and recognition in the travel industry. | Growing brand presence but less recognized compared to GetYourGuide. |

Supply | Has decent supply of experiences within India that can solve for domestic demand from Indian nationals. This will lead to discovering international destinations too. | Low supply of experiences in India at the moment. |

User Experience | Highly user-friendly platform with a focus on seamless booking and personalized recommendations. | Mobile-first approach with a simple interface, but may not yet match the technological sophistication of GetYourGuide. |

Viator

Core unique use cases:

Curated Local Experiences- Connects travelers with unique, locally-led tours and activities that may not be widely advertised.

User Reviews and Ratings- Emphasizes customer feedback to help users make informed decisions based on previous experiences.

Viator vs Headout

Aspect | Thrillophilia | Headout |

Established Brand | Part of the TripAdvisor family, Viator benefits from strong brand recognition and trust among travelers. | Growing brand presence but still establishing recognition compared to Viator's established reputation. |

Quality Assurance | In-house travel experts vet local operators, ensuring high-quality experiences for customers. | Relies on third-party operators; quality assurance may vary without the same level of vetting as Viator. |

Partnerships and Collaborations | Collaborates with trusted local operators to enhance offerings and ensure consistent service quality. | Currently building partnerships but may lack the extensive network that Viator has developed over time. |

Headout’s unique advantage over other platforms

UAE and Singapore is extremely popular among Indian nationals.

Headout attracts significant traffic using the following domains,

dubai-tickets.co

- monthly organic traffic is 16k. Gives direct competition to destination-targeted platforms such as Rayna Tours, Visit Dubai

singapore-tickets.co

- monthly organic traffic from India is 18k. Gives direct competition to marinabaysands.com, sentosa.com.sg

Market size:

On exploring the platform, following are some observations:

- Headout has curated experiences in 81 destinations

- Supply is low in India hence they are focusing on Indians traveling abroad. Currently the platform is not for domestic traveling in India

- Since the platform offers experiences (tickets, tours, adventures, sightseeing, food tours, nightlife etc), the purpose of anyone using the platform while traveling outside India would be: Leisure, Recreation and Holiday

In short, we need to acquire customers who are traveling abroad from India for vacation.

Let's look at the calculation:

Total population of India | 1450935791 | |

% of population of India that has internet | 52% | |

No. of indians that has internet | 754486611 | |

Total addresseable market for Headout (internet company) / TAM | 754486611 | ~750mn |

No. of Indian nationals' departures from India in 2022 | 21602734 | |

No. of Indian nationals' departures from India in 2023 | 28,000,000 | 28mn |

% growth (post-covid change) | 30% | |

No. of Indians booking for international air travel in 2024 (projected) | 36291703 | |

Serviceable addressable market for Headout / SAM | 36291703 | ~36mn |

% of Indian travelers traveling abroad for Leisure, Holiday & Recreation | 36.80% | |

No. of Indian travelers traveling abroad for Leisure, Holiday & Recreation/ SOM | 13355346.6 | ~13mn |

Serviceable Obtainable market by volume is 13mn.

Headout is in early scaling stage, hence looking to strategize on 3 things,

Channel framework:

1. Experiment with paid ads on Google -

I have built paid ads experiment keeping in mind audience behaviour of ICP 1 and ICP 3. Also, lead time is low, hence would get quick results which will help us tweak our strategies with respect to ad copy, creative, etc.

- ICP 1 prefers adventure and outdoor activities on their trips. Experimented with 2 ads based on this preference.

- ICP 3 looks for luxury and immersive experiences. Experimented with 2 ads relevant to this segment of the audience

2. Organic search -

It takes a long time (outreach campaigns for backlinks + constant optimization of own content) to establish domain authority and rank from 1 to 10 on SERP. Hence I am trying to get an early start to optimize for search.

- I have targeted keyword research only around those trending destinations where Indian nationals are traveling to according to tourism report

- keyword research for existing traffic, competitor traffic, google related search

- backlinks and content strategy

Also, CAC is low hence should definitely prioritise this channel.

3. Referral program -

Referral programs can fuel word-of-mouth for Headout in addition to the following things

- Social Proof: Potential customers are more likely to trust recommendations from friends and family.

- Cost-Effective: Referral programs can be a cost-effective way to acquire new customers.

- Goal-based reward: Implementing milestone rewards where customers earn greater incentives as they refer more people can encourage ongoing participation.

Currently Headout does not have a referral program. I have developed the same for mobile flow and website flow.

Trending countries to visit for leisure among Indians are,

UAE, THAILAND, SINGAPORE, MALAYSIA, INDONESIA.

(There are a couple of countries that have more Indian tourists but since has no supply of experiences there, we are only targeting countries that have destinations listed on Headout.)

Source: tourism.gov.in

We shall direct our efforts to rank for keywords related to the above country/destination searches.

A. Keyword Research

Existing traffic

Low hanging fruits : Improving positions on keywords that are low volume and easy to rank for will build authority and help the lower pages rank better. Below are examples of low-hanging keywords and their positions.

I have tried to include bottom of the funnel intent keywords to drive conversion by ranking on those keywords.

Avoiding keywords that are positioned beyond 30 as it will take high effort to rank for them.

Containing word: Dubai

Position: 4 to 10

Keyword Difficulty: Easy/Possible

Intent : Transactional (bottom of the funnel intent)

List of keywords: https://docs.google.com/spreadsheets/d/13WmAZC_aSB-ZPmBWN27JI8S-rLfophGapfK7jkk6WpI/edit?usp=sharing

Containing word: phuket

Intent: Transactional

List of keywords: https://docs.google.com/spreadsheets/d/1s4XYl2ZOs990-juDWhM4U8TQmoDCW0_DT-PedDM_iwM/edit?usp=sharing

Similarly for,

Containing word: singapore, sentosa, bali

Lists of keywords:

https://docs.google.com/spreadsheets/d/18_KPN52KY_K6tfOU05TT8I8B5wIwx9hDXlenTZGwjac/edit?usp=sharing

https://docs.google.com/spreadsheets/d/13J3Xg6f7TAFvoJHSvRfSR23jC0c86vw-Iro3-pHXziQ/edit?usp=sharing

Missing keywords

Picking easy to rank on keywords that our competitors are ranking for, but Headout is not ranking on them yet.

Below is a list of keywords for which Headout has a Right To Win and competitors are ranking on them:

https://docs.google.com/spreadsheets/d/1fDhja0Y3sGLLzSx9kgdOhk7TYGNlctvLRfuSYrF3Dtc/edit?usp=sharing

Google related search

Below is a list of keywords ideated Google related search.

Prioritising them on the basis of Volume, KD, Competition Density.

If we have to select the top 4 keywords from this list, selection would be

Main agenda is to maximize reach in lowest competition first to slowly increase our site authority. Once that is done, it would be easier for us to rank on high competition keywords and consequently get more reach since these high competition keywords always have high traffic volume.

B. Link Building

Headout’s authority score is lower than its competitors. We can target outreaching backlink prospects with high authority score.

This is a list of domains that we can outreach asking for a backlink. Filters used are,

- country

- Authority Score above 90

- domains that have NOT linked to Headout yet but have backlinks linked to competitor websites

- we should also look at number of backlinks the prospect has e.g nytimes 800m+ backlinks from 1.8m domains

- Outreach for backlink prospects :

(Using the below message through Semrush’s Link Building Tool)

Hi there! I hope this message finds you well. I am Sumana, Growth Manager from Headout, a mobile-first marketplace dedicated to helping travellers discover and book unique experiences around the world. I admire the content on your website <xxxx> and believe that a collaboration could be mutually beneficial. We have high-quality resources and travel insights that would complement your audience's interests perfectly.

The URL to my website is www.headout.com Would you be open to discussing a potential backlink partnership? I’m confident this could enhance the value we both provide to our readers. Looking forward to your response!

- Selected a few high volume, relevant to the trending destinations keywords in the Link Building Tool

- Next, I selected 10 domains which have high Authority Score and moved them to ‘in progress’

- Customising each email based on who the prospect is and sending an outreach email

We can do this repeatedly for as many selected prospects as we want.

C. SEO Optimized Content

- I want to target keywords with search intent either ‘Commercial’ (browsers will make a purchase in the future and only researching now) OR ‘Transactional’(browsers ready to purchase).

- Example - keyword ‘burj khalifa ticket booking’ has a Transactional intent. For this keyword Semrush shared some recommendations. I also checked how my competitors are using the keyword in their domains and sub-domains.

- Used SEO writing assistant to compose an article for the keyword ‘burj khalifa ticket booking’ with a readability score of 8.6.

Link to the article: https://docs.google.com/document/d/1N2ApajbcrMpvH8vJgmwkdSrm6OBTdO6r8SxB2oP93lU/edit?tab=t.0

Channel not prioritised for this project.

Expected LTV, CAC of each ICP

LTV = Avg. Booking value X Frequency X #booking done through the platform/trip X Retention

In order to achieve a CAC:LTV ratio of at least 3 (i am taking a healthy number here based on industry standards), I calculated the CACs for each ICP.

Solo traveler with budget | |

|---|---|

LTV | 50000 |

CAC | 17000 |

Family tripper with luxury | |

|---|---|

LTV | 330000 |

CAC | 110000 |

In summary, we are going to explore both ICPs for paid ads keeping an eye on CACs while planning on ad spends.

Channel selection:

For the scope of this project, I am exploring the following 2 channels.

Other paid channels such as Facebook and Instagram can also be targeted but since Headout is in early scaling stage, I am experimening with 2 channels for now.

(please open toggles to read)

Paid ads for ICP 3: family-tripper with luxury

Audience segment and travel behaviour - ICP 3

Google ads:

Based on their preferences, I am selecting 2 landing pages for which we can explore Google ads for ICP 3/Family travelers with luxury

Category of experience we will show ads for: Luxury cruise, Immersive experiences

- URL:

AD HEADLINE: Dubai Marina Cruise

AD DESCRIPTION: Experience luxury Yacht Cruises Dubai Marina — Book now with free cancelation and 24/7 support. Dubai Marina cruises offer breathtaking views, premium onboard dining, and the best prices.

Sitelinks:

- Dhow Dinner Cruise

https://www.headout.com/dubai-marina-cruise-dhow-dinner

Enjoy a traditional Arabian experience with dinner on a Dhow. - Luxury Yacht Experience

https://www.headout.com/dubai-marina-cruise-luxury-yacht

Sail in style aboard our luxury yachts with meals and drinks. - Sightseeing Cruise

https://www.headout.com/dubai-marina-cruise-sightseeing

Take in the stunning views of Dubai's skyline on our sightseeing cruise.

- URL:

landing page

AD HEADLINE: Immersive Theatre Dubai — Tailored to You

AD DESCRIPTION: Looking for a personalized theater experience? Let us plan the perfect Immersive Theatre Dubai adventure just for you. From interactive performances to exclusive shows, we'll curate an unforgettable experience based on your unique tastes. Enjoy hassle-free booking, free cancelation, and 24/7 customer service.

Sitelinks:

- Luxury Transportation for Events

https://www.headout.com/luxury-transport-dubai

Add a touch of comfort and class to your night out with chauffeured rides to your immersive experience. - Cultural & Artistic Tours

https://www.headout.com/dubai-art-tours

Combine your love for theater with a curated tour of Dubai’s top cultural spots. - Dining & Show Packages

https://www.headout.com/dubai-dining-show-packages

Enjoy a personalized evening with a dining experience paired with your favorite immersive shows. - Custom Curated Dubai Experiences

https://www.headout.com/custom-dubai-experiences

Let us tailor a full day of activities around your unique tastes and preferences. - VIP Access & Premium Events

https://www.headout.com/vip-experiences-dubai

Get exclusive access to the most sought-after immersive performances and experiences.

Youtube ad

Ad Headline:

Exclusive Luxury Dubai Desert Safari: Adventure Awaits!

Ad Description:

Indulge in an exclusive luxury experience with thrilling dune bashing, camel rides, and a gourmet dinner under the stars!

Sponsored: https://www.headout.com/dubai-desert-luxury-safari-tours-c-3726/

Paid ads for ICP 1: solo-traveler with budget

Audience segment and behaviour

Google ads:

Based on their preferences, I am selecting 2 landing pages for which we can explore Google ads for ICP 1/Solo travelers with budget.

Category of experience we will show ads for: Adventure/outdoor activities

- URL Ad Headline:

Thrilling White Water Rafting & ATV Ride in Phuket!

Ad Description:

Experience the excitement of white water rafting and an ATV ride in Phuket! Book your adventure today for an unforgettable journey through nature.

Sitelinks:

- Book Now

Secure your spot for an adventure!

- Rafting Details

Learn more about the rafting experience.

- ATV Ride Info

Discover the ATV ride highlights.

- Customer Reviews

See what others are saying!

- URL Ad Headline:

Experience Thrilling Parasailing in Dubai!

Ad Description:

Take to the skies and enjoy breathtaking views of Dubai while parasailing! Book your unforgettable adventure today.

Sitelinks:

- Book Now

Reserve your spot for a thrilling parasailing experience and secure an unforgettable adventure high above the stunning Dubai coastline!

- Adventure Details

Explore what awaits you during your parasailing trip, from safety measures to stunning views of iconic landmarks.

- Safety Information

Learn about our comprehensive safety protocols to ensure a secure and enjoyable experience for all participants.

- Customer Reviews

Read testimonials from fellow adventurers who have soared above Dubai and discover their memorable experiences!

Channel not prioritised for this project.

Who will refer Headout to their friends :

- Customers of Headout who want to earn more Headout credits for their next trip

- Customers who are satisfied with the experience of booking with Headout.

[For the scope of this project I have detailed out the flow for scenario 1. Since I have not booked and paid for an experience with Headout yet, I am unable to share that flow.

However, the referral landing pages and messages would be the same for both scenarios. ]

How and where will they discover the referal program:

Mobile flow

Screen 1 : Welcome screen. You see this screen whenever you open the app.

Screen 2: When you click on Account, you goto Screen 2.

Suggestion is to add a new block ‘Referrals and Credits’ between ‘My Account’ and ‘Help’ blocks.

Click on the next button on the new block.

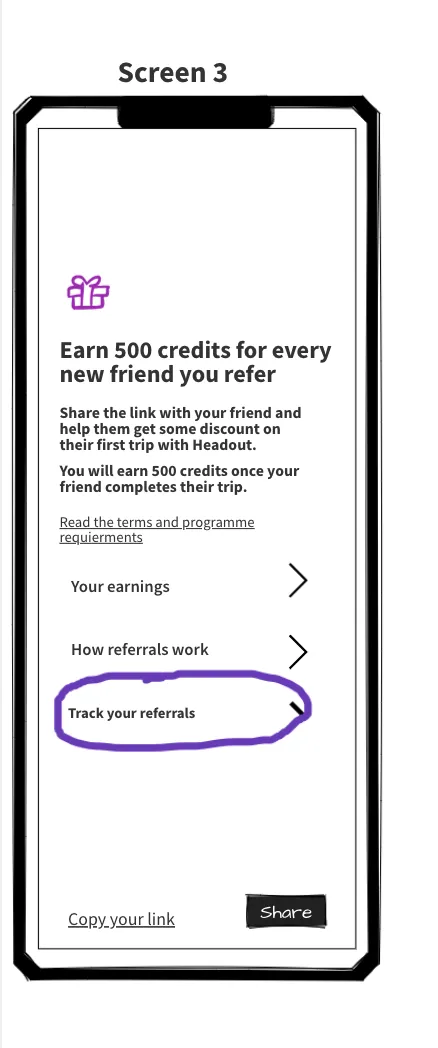

Screen 3: Giving some information on what the referral program is about. Clicking on ‘Share’ button, we goto Screen 4.

Screen 4: We get to choose the communication channel for sharing the referral.

Screen 5: Communication on whatsapp

Web flow

Screen 1:

On clicking on ‘Account’ button, the dropdown we see does not have the word ‘Referrals’.

My suggestion is to make it ‘Referrals and Credits’.

Screen 2:

Screen 3:

On clicking ‘Refer a friend and earn credits’ we get the below screens

On clicking ‘Headout Traveler Referal Program’

Referral tracking and incentive:

In the mobile flow, after clicking on ‘Referrals and Credits’ we get a next button.

On clicking on that button, we get the below screen 3.

Click on ‘Track your referrals’

Also, give incentive to make 30 successful referrals.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.